STEP 0.5- If you deposit the business sale proceeds into a bank or savings and loan, understand how the deposits are guaranteed and the insured limits. It is likely your business sale proceeds will exceed the insured guarantees, consider other instruments such as US Treasury bills to manage your risk so you can follow STEP 1.

STEP 1-What is the very first piece of advice I believe should be offered to business owners post sale?

Take your time, don’t be in a hurry to make decisions about what to do with the proceeds.

STEP 2- If you are taking your time with the proceeds, what is the second step I recommend?

De-risk your family

If you have not already done so, here are 15 things I think you should do as soon as possible post sale, ideally if possible, pre-sale.

- A contingency plan for the surviving spouse or family member(s) if something should happen to you and/or your spouse.

- Review how all the assets are titled. While you’re at it review the beneficiaries of all retirement accounts and insurance policies.

- Do you have your estate plan in place? Is it up to date?

- If you deposit sale proceeds into a local institution, understand how they are guaranteed, if they are and the insured limits.

- Make sure your healthcare insurance provides coverage post sale.

- Consider a durable medical power of attorney for you and your spouse.

- Inventory your advisors and assess if you have the right people in the right seats. Your pre- sale team might be equipped to adequately help with pre-sale tasks, yet may not be the team that better serves your needs with requisite skill sets with what can be a very large liquidity event.

- Create a vivid vision for what you want your life to look like post sale, 5,10,20 years in the future. Go from that future point, work backwards to now. Write it down. Share it with your spouse. Your spouse’s vivid vision may be different than yours. The old saying for better or worse, but not for lunch comes to mind.

- Create a to do list and prioritize it, do the most important thing first.

- Stress test your situation, is everything pointed at the person entity or destination you intended.

- What might the income tax and estate tax consequences of your current state residency and titling of assets suggest. Be sure it is effective at delivering what you want?

- Adopt a written document that details where the family heirlooms are to go, it might preserve the friendship of your children and clarify and mitigate any potential conflicts. Even a video narrated by you would be of use.

- To stay mentally engaged; consider joining a mastermind group of entrepreneurs. Share your experience and stay current.

- Read a book a week, listen to podcasts. Feed the machine.

- Manage Legacy Risk and your health. Consider if concierge medicine is for you. We all know business owners that sold and died soon thereafter. Don’t be that person due to neglect. There is only one Superman and that’s not you.

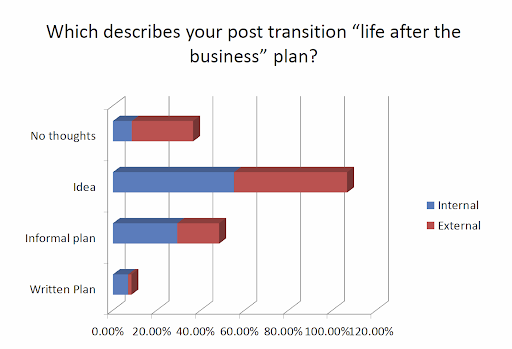

The post sale planning statistics are telling. According to the 2013 State of Owners Readiness Survey co-sponsored by the Exit Planning Institute, only 4% of surveyed business owners have a formal written life after business plan. Perhaps not surprisingly general surveys of business owners claim up to 75% of business owners are dissatisfied with the result post transition.

“State of Owner Readiness” © Survey Results 2013 © Copyright 2013 Exit Planning Institute

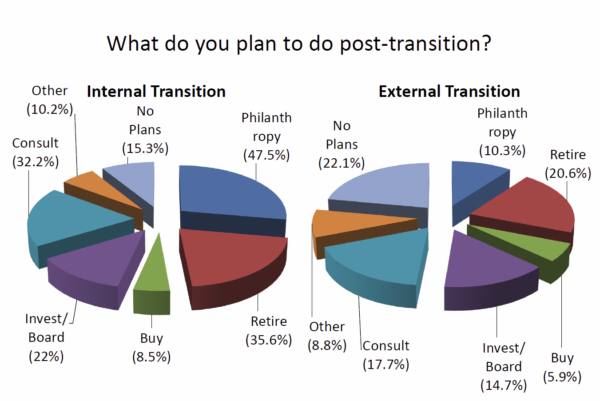

According to the same survey of business owners when asked what do you plan on doing after the business sells. If there is a vivid vision picture of post-sale life, it makes on wonder what “other and “no plans” look like. Likely disappointing.

There are likely many more post sale de-risking strategies. Owners should prioritize and focus on strategies that present the most negative consequence for their family and address those first.

I have found the strategy that is most effectively in implementing prioritized de-risking tasks. Write the tasks down, get buy in from your spouse, focus on five actionable steps that can be completed in the next ninety-day time period. Track the progress of each item on your list. Either you are responsible or assign responsibility for completing the task. At 90 days out, either done or not done. No excuses. Protect your family and your legacy, you have earned it and they deserve it.